Weekly Bond Market Report, FRIDAY FEBRUARY 06, 2026

T-Bills Hit 267.8% Oversubscription as Government Prepares to Cut Taxes, Raise PAYE Threshold to Sh30,000, and MPC Meeting Looms—Plus Safaricom Boosts Dividends by 54.5%!

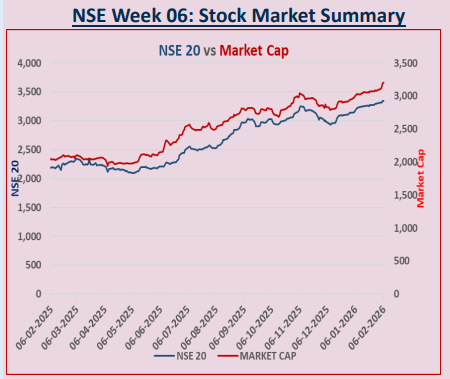

Market Overview

During the week ended 06th February 2026, the market showed a robust performance in the bond market, equities, derivatives, Eurobonds and the international market.

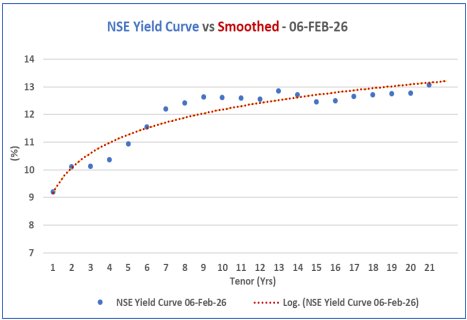

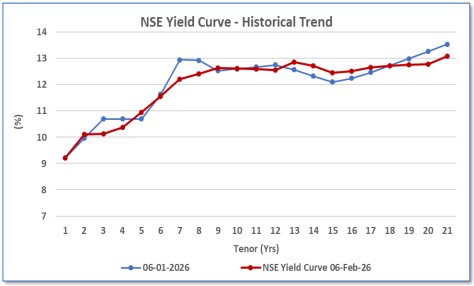

The NSE yield curve has generally edged upwards in the medium-term end 5 to 8-year horizon while remaining relatively stable in the short-term and a relative decline in the long-term end.

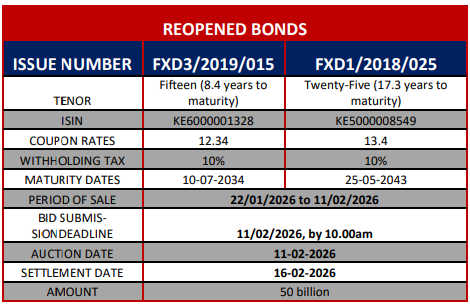

CBK continued to broadcasted the prospectus for the reopened 15-year and 25-year fixed-coupon Treasury bonds; FXD3/2019/015 and FXD1/2018/025 with the bid submission deadline being the coming week on 11th February 2026.

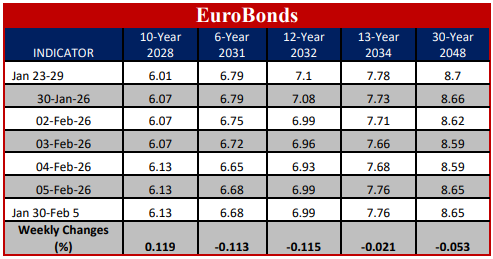

Yields on Kenya’s Eurobond declined for the fifth consecutive week by an average of 3.65 basis point compared to the previous week. The Eurobonds performed generally stable in most part of Africa.

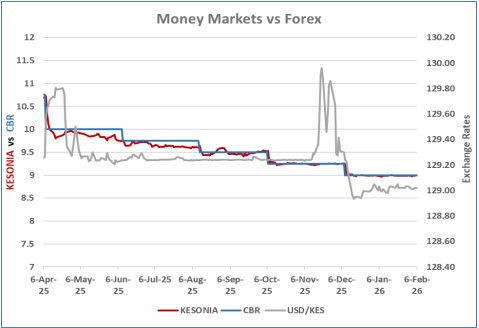

The Kenya Shilling remained stable against major international and regional currencies during the week ending February 6th , 2026. It exchanged at KES 129.02 per U.S. dollar on average over the week.

The Monetary Policy Committee is meeting on Tuesday, February 10th, with high expectation. The MPC has observed a 25 basis point rate cut, probably, the trend will continue. However FED, and Bank of Japan retained their rates.

The Kenyan inflation lowered to 4.4% from 4.5% in December last year. This shows stability of the economy and the market. International oil prices increased with Murban oil trading at USD 68.46 per Barrel.

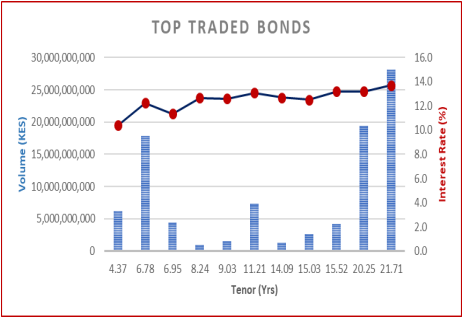

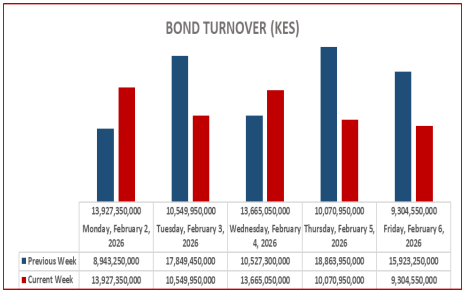

Bond turnover in the domestic secondary market declined over the week by 20.23% closing at 57.5 billion.

Interest Rate Outlook

The Kenya Shilling has been stable for the past weeks with no aggressive fluctuations, most specifically against the US dollar.

It exchanged at KES 129.01 per U.S. dollar on February 3rd, compared to KES 129.02 per US dollar on February. On average the Kenyan Currency against the USD exchanged at KES 129.02 over the week.

Central Bank Rate (CBR) dropped to 9.00% from 9.25% following the Monetary Policy Committee (MPC) meeting held on 9th December 2025. This shows a trend of 25 basis points cut– rate for the past preview. The next meeting is scheduled in the coming week on Tuesday February 10, 2026, with the expectations drawing high.

KESONIA increased to 9.99% on February 6 .

Short End of the Yield Curve and Inflation Trends

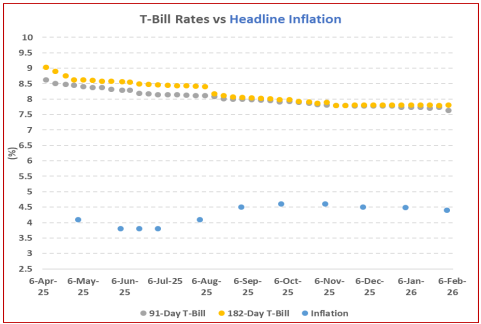

The inflation continues to fall currently being at 4.4% from 4.5% in December last year. This shows stability of the economy and the market.

This week, T-bills saw an oversubscription rate of 267.8%, up from last week's 196.7%.

Investors favoured the 91-day paper, achieving a subscription rate of 323.9% with bids of KES 13.0 B against KES 4.0 B offered.

The 182-day paper's subscription rate declined to 5.0%, while the 364-day paper's rate increased to 508.3% from 385.8%. The government accepted KES 50.0 B of the KES 64.3 B bids, yielding an acceptance rate of 77.8%.

Yields on government papers decreased slightly, with the 182- day paper down by 1.2 bps to 7.8% , the 364-day down by 0.7 bps to 9.2% , and the 91-day down by 0.3 bps to 7.6% from the previous week

Kenya Secondary Bond Market Trends

The NSE yield curve has generally edged upwards in the medium-term end 5 to 8 -year horizon while remaining relatively stable in the short-term and a relative decline in the long-term end.

Week-on-week traded volumes have generally been consistent across the two week period with turnover spiking within the week, the turnover declining with a margin of 20% for the week ended 6th Feb 2026.

Kenya Primary Bond Market

Treasury Bond Auctions

Reopened Bonds:

CBK continued to broadcast the prospectus of issuance of 15-year and 25-year fixed-coupon Treasury bonds, with the objective of raising KES 50 billion for budgetary assistance.

The 15-year bond (FXD3/2019/015) features a coupon rate of 12.34% and is set to mature in 2034, whereas the 25-year bond (FXD1/2018/025) provides a coupon rate of 13.40% and matures in 2043.

The deadline for bids is 11 February 2026, with the settlement date scheduled for 16 February 2026.

International Bond Markets

U.S.A Treasury yields were mixed to slightly lower early in the week, with the 10-year yield dropping to about 4.19% due to caution and soft economic data. The yield curve steepened, reflecting expectations of future Federal Reserve rate cuts under new leadership. Softer U. S. labour and macro data drove speculation about rate cuts later in 2026, which generally benefits bonds. Market attention was focused on the delayed U.S.A jobs report and CPI figures, making bond traders careful. A global watchdog warned of risks in the bond-backed repo market, highlighting vulnerabilities that could increase stress in U. S. Treasuries.

In the UK, the Bank of England kept its policy rate at 3.75% and indicated potential cuts later this year. Market expectations anticipated the rate falling to around 3.0% by Q1 2027, with gilt yields adjusting modestly. Political and economic uncertainties affected market sentiment. German Bonds remained stable, with markets expecting the ECB to maintain steady rates.

In Japan, government bonds showed volatility ahead of a snap election, with yield movements reflecting fiscal stimulus discussions.

In China, 10-year bond yields rose amid changing investor positions ahead of policy meetings. Concerns about liquidity and repo market vulnerabilities were highlighted globally as significant factors affecting sovereign debt markets.

Kenya Eurobond Market

Yields on Kenya’s Eurobonds performed relatively lower over the week.

On average, yields declined by average of 3.65 basis points across outstanding Eurobond issues. This suggests some downward price movement or rebalancing by investors in response to global market conditions.

In attachment, is the performance of the Daily Eurobond turnover for the week ended 6th February 2026 in statistical way

Bulletin Board

KPC Privatisation

International Market

In the four quarters leading up to Q3 2025, UK-Kenya commerce totaled £2.1 billion, up 9.2% year over year. Kenya is now the 71st largest trading partner of the United Kingdom, accounting for about 0.1% of overall trade, as UK exports increased 4.5% to £765M and Kenyan imports increased 12% to £1.4B.

Ethiopia's capital markets regulator is seeking to engage Kenyan stockbrokers, investment banks, and various intermediaries in order to draw in local investors as the market becomes accessible to foreign investors

Safaricom Interim Dividend

Safaricom has raise its interim dividends by 54.5% to KES 0.85 per share for the fiscal year 2026, with boo closure date schedule for February 25, 2026, and payment acticipated on or around March 31, 2026.

Taxation

The government intends to modify tax legislation in Kenya through two primary measures:

Increase the PAYE tax-free threshold from KES 24,000 to KES 30,000

Reduce the tax rate on incomes ranging from KES 30,000 to KES 50,000 to 25% from the previous rate of 30%