BOND MARKET WEEKLY, FRIDAY JANUARY 2, 2026

The week ending 2nd January 2026 offered early clues on investor sentiment, government borrowing strategy, and what to watch as markets regain momentum. Here’s how the first trading week of 2026 unfolded, and why it matters.

Market Overview

During the week ended 2ND JANUARY 2026, the market showed a slow performance in the bond market, equities, derivatives, Eurobonds and the international market, being a new– year week.

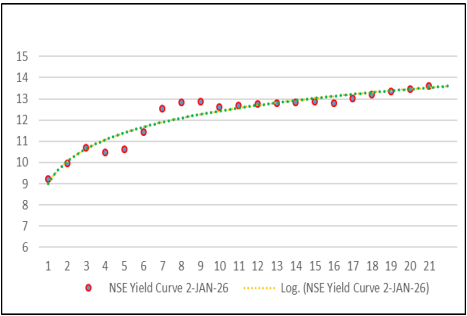

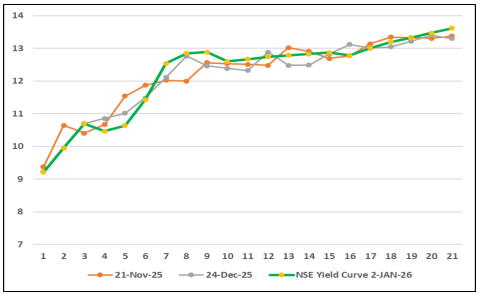

The NSE yield curve has generally edged upwards in the medium-term end 5 to 8 year horizon while remaining relatively stable in the short-term and long-term end.

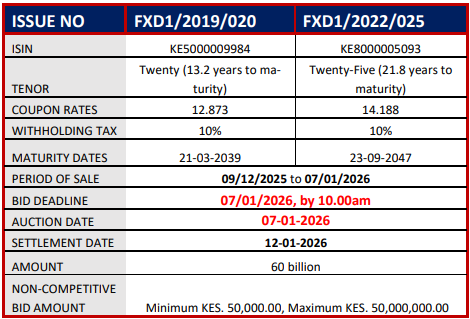

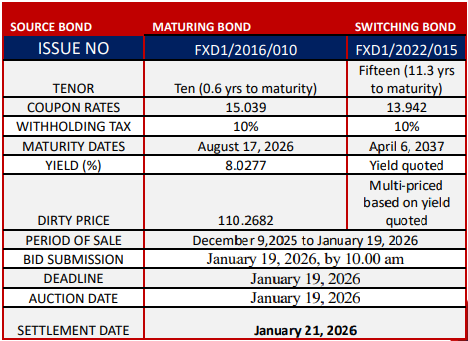

During the week CBK continued to air the prospectus for the reopened –20 and –25 years treasury bonds— FXD1/2019/020 and FXD1/2022/025 with the auction and settlement date being 7th January 2026 (Wednesday- next week). Similarly , they continued to air prospectus for the switch from FXD1/2016/010 which is maturing next year, to re-opened FXD1/2022/015 with the auction and settlement date being 19th January 2026.

Yields on Kenya’s Eurobond decreased by 8.4 basis point on average compared to the previous week. However it indicates modestly increased dependency in external borrowing in Kenya and most African nations.

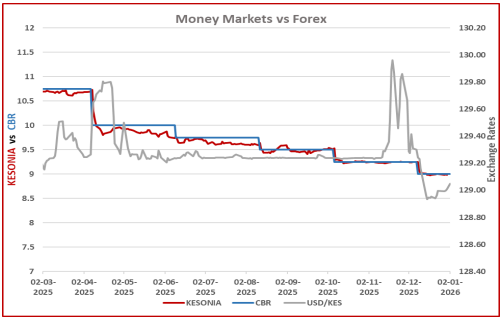

The Kenya Shilling remained stable against major international and regional currencies during the week ending JANUARY 2, 2026. however it gained strength against the US Dollar over the week. It exchanged at KES 129.00 per U.S. dollar on average for the week.

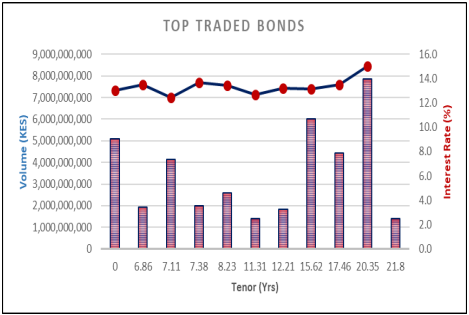

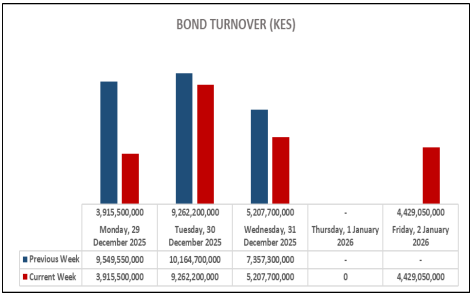

Bond turnover in the domestic secondary market decreased by 32.10% during the week ended 2nd JAN 2026.

The Monetary Policy Committee lowered the Central Bank Rate (CBR) to 9.0% at its December 9, 2025 meeting. This affects all related factors including the KESONIA ands lending rates expected to lower.

Interest Rate Outlook

Money Market Trends

The Kenya Shilling remained stable against major international and regional currencies during the week ending January 02, 2026.

It gained strength against the US Dollar. it exchanged at KES 128.99 per U.S. dollar on December 29, compared to KES 129.01 per US dollar on January 02. On average the Kenyan Currency against the USD exchanged at KES 129.00 over the week.

Central Bank Rate (CBR) dropped to 9.00% from 9.25% following the Monetary Policy Committee (MPC) meeting held on 9th December 2025. This sows a trend of 25 basis points cut – rate for the past preview.

Short End of the Yield Curve and Inflation Trends

This week, T-bills saw an oversubscription at 108.0%, a notable increase from the previous week's 22.5%.

The 91-day paper was particularly favored, with KES 6.3 billion in bids against KES 4.0 B offered, resulting in a subscription rate of 158.2%.

Subscription for the 182-day paper rose to 112.9% and the 364- day paper to 83.0% . The government accepted KES 25.909 billion of bids from KES 25.917 billion submitted, achieving a 99.97% acceptance rate.

Yields varied, with the 182-day yield stable at 7.8% , the 91- day yield slightly up by 0.1 bps to 7.73%, and the 364-day yield down by 0.1 bps to 9.21%.

Kenya Secondary Bond Market Trends

The NSE yield curve has generally edged upwards in the medium-term end 5 to 8 year horizon while remaining relatively stable in the short-term and long-term end.

Week-on-week traded volumes have generally been consistent across the two week period with turnover spiking in mid week; however it was affected by the festive– holiday days.

The bond market ended December 24, 2025 showed a marginal FALL in performance closing at KES 18.40 billion from KES 27.10 Billion in the Week ended 2nd JAN 2026

Kenya Primary Bond Market

Treasury Bond Auctions

CBK is offering investors a voluntary switch from Treasury bond FXD1/2016/010 (10Year, 15.039% coupon, maturing August 2026, yield 8.0277% ) to the re-opened FXD1/2022/015 (15Year, 13.942% coupon, maturing April 2037). See table below.

The KES 20 billion auction runs 9 December 2025 – 19 January 2026, with settlement on 21 January 2026.

The Central Bank of Kenya also look forward to collecting 60 billion from the reopened 20 year (FXD1/2019/020) and 25- year (FXD1/2022/25) fixed-coupon Treasury bonds.

Sale runs 9 December 2025 – 7 January 2026, with settlement on 12 January 2026. Their coupons are : 12.873% (20Year) & 14.188% (25Year). See table 1

International Bond Markets

In the U.S., Treasury yields increased slightly, with the 10-year yield at 4.19%, driven by light holiday trading and a record in repo borrowing signaling liquidity demands.

The UK experienced a modest rise in gilt yields, closing at 4.54%, as expectations for gradual Bank of England rate cuts influenced the market.

Japan's government bond yields saw a significant increase, with the steepest rise since 1994 attributed to reduced Bank of Japan purchases and inflationary pressures.

Broader Asian markets anticipate upward pressure due to heavy supply and a concluded rate-cut cycle.

Germany's Bond yields remained elevated near previous highs this week.

Kenya Eurobond Market

The bond market ended December 24, 2025 showed a marginal FALL in performance closing at KES 18.40 billion from KES 27.10 Billion in the Week ended 2nd JAN 2026.

In the international market, yields on Kenya’s Eurobonds decreased by 8.4 basis points on average. See table 2.

In attachment, is the performance of the Daily Eurobond turnover for the week ended 2nd January in statistical way.

Bulletin Board

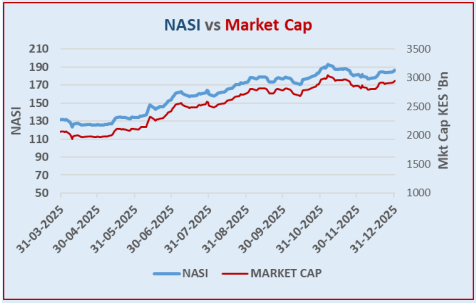

NSE Week 01: Stock Market Summary

Bonds Turnover: KES 18.4B (-14.43%)

Equity Turnover: KES 1.07B (-25.21%)

Top Gainer: Nation Media Group KES 12.70 (+9.96%)

Top Loser: BK Group Plc KES 40.55 (-4.59%)

NASI: +0.41% to 187.35

Market Cap: KES 2.956T (+1.83%)

EABL

British multinational company Diageo has agreed to sell its entire 65% stake of ownership in East Africa Breweries Limited (EABL) to Japanese Beverage firm, ASAHI Group holdings.

The deal is worth KES 296.6 net of tax and transaction costs. This comes months since Nik Jhangiani, Diageo’s interim chief executive, said the company was planning significantly divestments to help reduce its debt burden.

EABL bought the firm for 22 Billion in 2023 and is selling at 69 Billion making a 47 Billion profit in 2025 CMA has raised queries and pushed East Africa Breweries to explain the firms raising KES 16.8 billion through a bond and the announcement of Diageo exit within a span of 39 days, happening concurrently

FOREX Reserves

Kenya's forex reserves surged by $68M this week to USD 12.15B equivalent to 5.3 months of import cover.