WEEKLY BOND MARKET REPORT, FRIDAY JANUARY 30, 2026

Kenya's T-Bills Explode to 196.7% Oversubscription as Shilling Holds at 129.02, Inflation Drops to 4.4%, and Treasury Launches Fully Automated Debt Platform—Here's What Investors Need to Know!

Market Overview

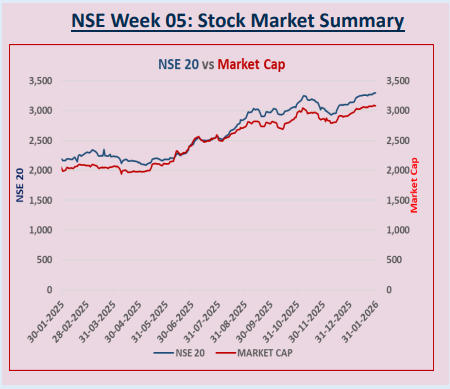

During the week ended 30th January 2026, the market showed a robust performance in the bond market, equities, derivatives, Eurobonds and the international market.

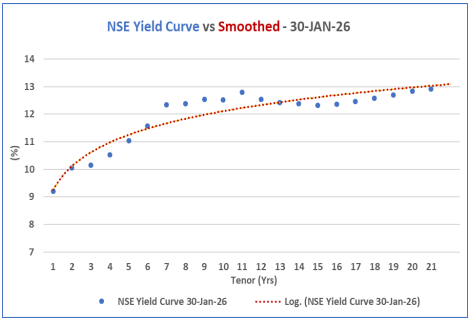

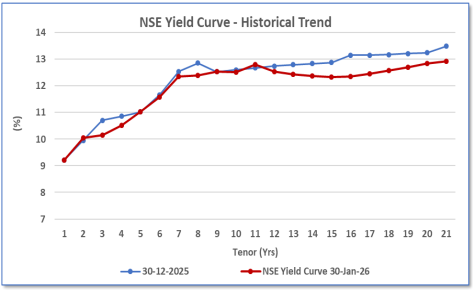

The NSE yield curve has generally edged upwards in the medium-term end 5 to 8 -year horizon while remaining relatively stable in the short-term and a relative decline in the long-term end.

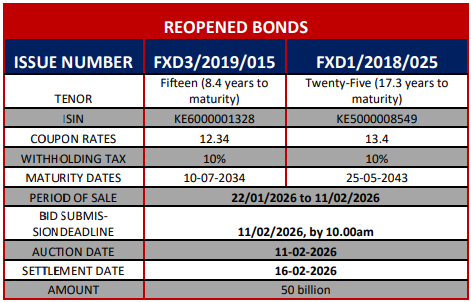

CBK continued to broadcasted the prospectus for the reopened 15-year and 25-year fixed-coupon Treasury bonds; FXD3/2019/015 and FXD1/2018/025 with the bid submission deadline being 11th February 2026.

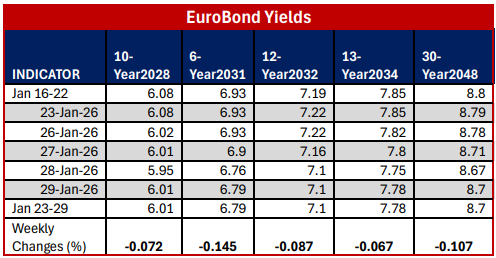

Yields on Kenya’s Eurobond declined for the forth consecutive week by an average of 9.59 basis point compared to the previous week. The Eurobonds performed generally low in most part of Africa.

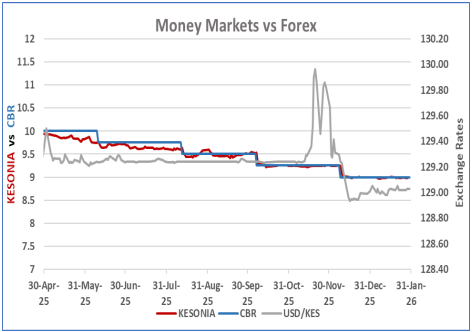

The Kenya Shilling remained stable against major international and regional currencies during the week ending January 30, 2026. It exchanged at KES 129.02 per U.S. dollar on average for the week.

The Monetary Policy Committee lowered the Central Bank Rate (CBR) to 9.0% on December 9, 2025 meeting. The next MPC meeting is scheduled in February 10th.

Internationally, Federal Reserve in US, Bank Of Japan and Bank of Canada held their Monetary Policy Meeting, however, the rates were held and remains unchanged.

Murban oil traded at $ 68.46 on January 30th.

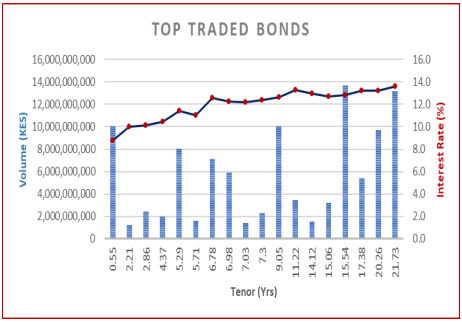

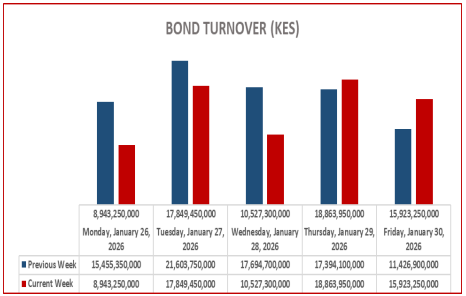

Bond turnover in the domestic secondary market declined over the week by 15.9% closing at 72.1 billion.

Interest Rate Outlook

Money Market Trends

The Kenya Shilling remained stable against major international and regional currencies during the week ending January 30, 2026.

It exchanged at KES 129.02 per U.S. dollar on January 23rd, compared to KES 129.03 per US dollar on January 29th . On average the Kenyan Currency against the USD exchanged at KES 129.02 over the week.

Central Bank Rate (CBR) dropped to 9.00% from 9.25% following the Monetary Policy Committee (MPC) meeting held on 9th December 2025. This shows a trend of 25 basis points cut– rate for the past preview. The next meeting is scheduled in February 10, 2026, with the expectations drawing high.

KESONIA remained relatively stable at 8.99% on 30th Jan .

Short End of the Yield Curve and Inflation Trends

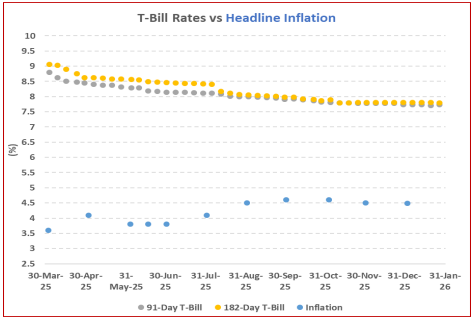

This week, T-bills saw an oversubscription rate of 196.7%, up from 76.5% the previous week.

The 91-day paper was highly favoured, achieving a subscription rate of 158.8% with bids of KES 6.4 billion against KES 4 billion offered.

In contrast, the 182-day paper's subscription dropped to 22.8% from 88.3%, while the 364-day paper surged to 385.8% from 81.5%.

The government accepted KES 47.18 billion of the KES 47.21 billion bids received, recording a 99.9% acceptance rate.

The inflation continues to fall currently being at 4.4% from 4.5% in December last year. This shows stability of the economy and the market.

Kenya Secondary Bond Market Trends

The NSE yield curve has generally edged upwards in the medium-term end 5 to 8 -year horizon while remaining relatively stable in the short-term and a relative decline in the long-term end.

Week-on-week traded volumes have generally been consistent across the two week period with turnover spiking within the week, the turnover declining with a margin of 16% for the week ended 30th January

Kenya Primary Bond Market Trends

Treasury Bond Auctions

Reopened Bonds

CBK continued to broadcast the prospectus of issuance of 15- year and 25-year fixed-coupon Treasury bonds, with the objective of raising KES 50 billion for budgetary assistance.

The 15-year bond (FXD3/2019/015) features a coupon rate of 12.34% and is set to mature in 2034, whereas the 25-year bond (FXD1/2018/025) provides a coupon rate of 13.40% and matures in 2043.

The deadline for bids is 11 February 2026, with the settlement date scheduled for 16 February 2026.

International Bond Markets

U.S. stock markets ended the week lower. Investor sentiment weakened due to uncertainty around Federal Reserve leadership and mixed corporate earnings.

European equities outperformed the U.S. on a relative basis. Banking and cyclical stocks attracted inflows, supported by stable ECB policy. Europe was viewed as a lower-volatility allocation versus U.S. equities.

German DAX and STOXX indices benefited from earnings-led optimism. Investment flows were mixed and cautious. China and Hong Kong saw outflows, reflecting growth concerns.

Japan and South Korea remained stable, supported by domestic institutional demand. Global tech weakness limited risk appetite in Asian equity markets.

Kenya Eurobond Market

Yields on Kenya’s Eurobonds performed relatively lower over the week.

On average, yields declined by average of 9.59 basis points across outstanding Eurobond issues. This suggests some downward price movement or rebalancing by investors in response to global market conditions.

In attachment, is the performance of the Daily Eurobond turnover for the week ended 30th January 2026 in statistical way.

Bulletin Board

KPC Privatisation

The Government intends to divest a 65% interest in Kenya Pipeline Company by offering 11.81 billion shares at a price of KES 9 per share. [More details on how to buy]

EABL 2025 FINANCIAL REPORT

With 8% volume growth, flat operating costs, and a 36.8% decrease in finance costs, EABL produced a strong H1 FY26 performance, with net income rising 38% to KES 11.2B.

TREASURY DEBT MANAGEMENT

Kenya's National Treasury is scheduled to introduce a completely automated platform for external debt payments on 2 February 2026, operating within the Treasury Single Account framework. This platform will integrate Meridian DMS, CBK exchange rates, IFMIS, the Exchequer requisition process, and approvals from the Controller of Budget.

The new system will facilitate the complete digital generation, approval, and execution of external debt payments, thereby eliminating manual, paper-based workflows.

NSSF 2025 FINANCIAL REPORT

NSSF reported robust FY24/25 results, with net assets increasing by 43.1% to KES 575.1B. Investments in government securities rose 40% to KES 355.4B.

INTERNATIONAL MARKET

Angola is planning to issue a US$1.7 billion bond in international markets in 2026 as part of its strategy to secure US$16 billion in additional financing this year. The government aims to obtain US$8.4 billion from external sources, according to the finance ministry's borrowing plan.