WEEKLY BOND MARKET REPORT, FRIDAY JANUARY 9, 2026

The Kenyan financial markets kicked off 2026 with renewed momentum, shaking off the festive lull as bonds, equities, and international instruments moved decisively into focus. A combination of accommodative monetary policy, resilient currency performance, and surging market activity is setting the tone for what could be a defining year for investors positioning early.

Market Overview

During the week ended 9th January 2026, the market showed a robust performance in the bond market, equities, derivatives, Eurobonds and the international market, recovering from the festive season.

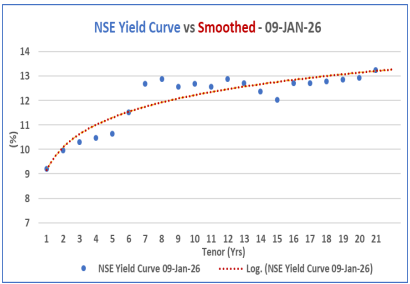

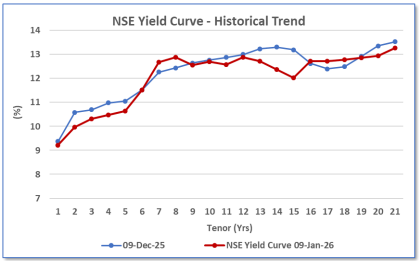

The NSE yield curve has generally edged upwards in the medium-term end 5 to 8 year horizon while remaining relatively stable in the short-term and long-term end.

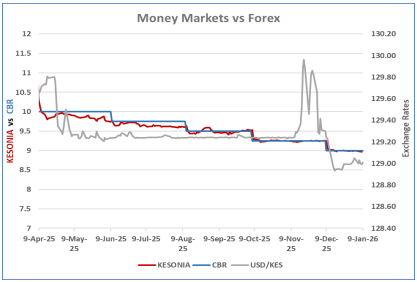

The Monetary Policy Committee lowered the Central Bank Rate (CBR) to 9.0% at its December 9, 2025 meeting. This affects all related factors including the KESONIA ands lending rates expected to lower.

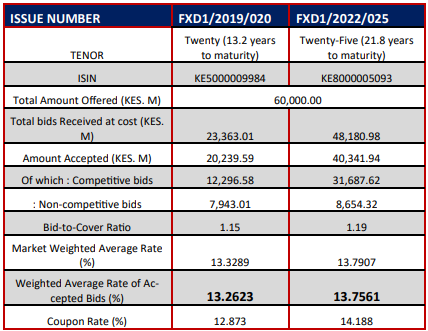

During the week CBK released the results for the re-opened –20 and –25 years treasury bonds; FXD1/2019/020 and FXD1/2022/025. Similarly, they continued to air prospectus for the switch from FXD1/2016/010 which is maturing next year, to re-opened FXD1/2022/015.

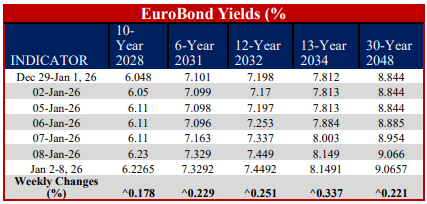

Yields on Kenya’s Eurobond increased by 24.3 basis point on average compared to the previous week. The Eurobonds performed generally well all over the continent.

The Kenya Shilling remained stable against major international and regional currencies during the week ending January 9, 2026. It exchanged at KES 129.01 per U.S. dollar on average for the week.

International oil prices declined during the week, Murban crude oil traded at USD 61 per barrel on January 9, from USD 62.51 per barrel on January 3rd, due to easing supply demand pressures.

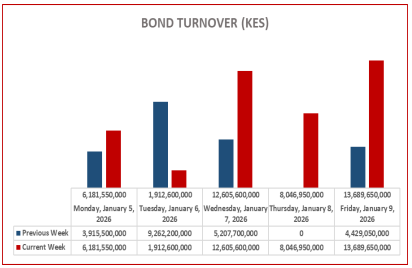

Bond turnover in the domestic secondary market increased by 77% during the week ended 9th Jan 2026.

Interest Rate Outlook

Money Market Trends

The Kenya Shilling remained stable against major international and regional currencies during the week ending January 09, 2026.

It exchanged at KES 129.01 per U.S. dollar on January 9th, compared to KES 129.05 per US dollar on January 2nd . On average the Kenyan Currency against the USD exchanged at KES 129.01 over the week.

Central Bank Rate (CBR) dropped to 9.00% from 9.25% following the Monetary Policy Committee (MPC) meeting held on 9th December 2025. This sows a trend of 25 basis points cut – rate for the past preview.

KESONIA remained relatively stable at 8.96% on 9th Jan .

Short End of the Yield Curve and Inflation Trends

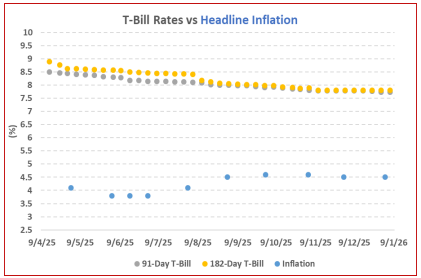

This week, T-bills experienced an oversubscription rate of 130.3%, an increase from 108.0% the previous week.

The subscription for the 91-day paper fell to 108.5% from 158.2%, receiving KES 4.3 billion in bids against an offer of KES 4.0 billion.

The 182-day paper's subscription decreased to 96.1% from 112.9%, while the 364-day paper's rate rose to 173.2% from 83.0%. The government accepted KES 26.2 billion of KES 31.3 billion bids, yielding an acceptance rate of 83.7%.

Yields for the government papers were mixed: the 182-day yield remained at 7.8%, while the yields for the 364-day and 91-day papers decreased to 9.20% and 7.728%, respectively.

Kenya Secondary Bond Market Trends

The NSE yield curve has generally edged upwards in the medium-term end 5 to 8-year horizon while remaining relatively stable in the short-term and long-term end.

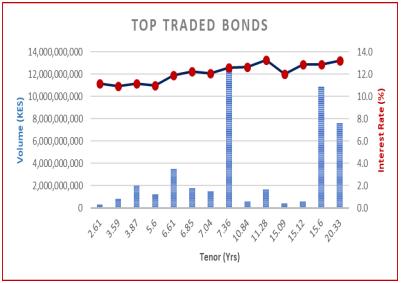

Week-on-week traded volumes have generally been consistent across the two week period with turnover spiking within the week;

Kenya Primary Bond Market

Treasury Bond Auctions

During the week, the Central Bank of Kenya released auction results for the reopened treasury bonds FXD1/2019/020 and FXD1/2022/025, which have maturities of 13.2 years and 21.8 years, and fixed coupon rates of 12.9% and 14.2%.

The bonds were oversubscribed at a rate of 119.2%, with bids of KES 71.5 billion against an offering of KES 60.0 billion. The government accepted KES 60.6 billion worth of bids, yielding an acceptance rate of 84.7%.

The weighted average yields for the accepted bids were 13.3% for FXD1/2019/020 (lower than 13.4% in November 2021) and 13.8% for FXD1/2022/025 (higher than 13.7% in November 2025).

With a current inflation rate of 4.5%, the real returns are 8.8% and 9.3%, respectively, and the tax-equivalent yields, considering the 10.0% withholding tax, are 14.1% and 14.6% for the respective bonds.

International Bond Markets

United States America’s; Treasury yields remained stable early in the week at around 4.18%, supported by slower job growth data influencing rate-cut expectations. Record global bond issuance and strong equity performance created a mixed sentiment in the fixed-income market.

United Kingdom; bond yields drifted lower to approximately 4.38% due to weak domestic activity and shifting rate expectations.

Germany; Bond yields fell to around 2.83% amid easing inflation and expectations for ECB policy changes.

Asia; significant bond issuance continued with strong demand.

Japanese government bond yields increased, reflecting inflation pressures and anticipated policy normalization.

Kenya Eurobond Market

Yields on Kenya’s Eurobonds rose during the week, indicating higher borrowing costs or risk perceptions in the international fixed-income market.

On average, yields increased by about 24.3 basis points across outstanding Eurobond issues. This suggests some downward price movement or rebalancing by investors in response to global market conditions.

In attachment, is the performance of the Daily bond turnover for the week ended 19th December in graphical and statistical way.

Bulletin Board

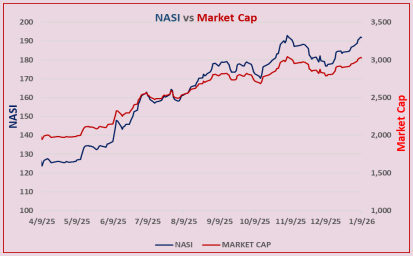

NSE Week 02: Stock Market Summary

Bonds Turnover: KES 42.24B (+82.33% )

Equity Turnover: KES 3.5B (+227.04% )

Top Gainer: Car and General KES 57.25 (+12.25% )

Top Loser: Standard Group KES 5.86 (-10.94%)

NASI: +2.41% to 191.87

Market Cap: KES 3,027.94B (+2.41%) - the highest in history.

Domestic Borrowing & Market

Even though domestic borrowing is expected to surpass KES 1 trillion for the first time in 2026, the Treasury anticipates additional interest rate reductions.

In the first nine months of last year, Kenya's trade deficit with China increased to KES 475.6 billion, demonstrating a growing imbalance in bilateral trade.

In one of its biggest asset sales in recent years, the CBK listed 281tonnes of outdated and unusable Gold for sale

EABL Sale

The High Court has deemed the case brought by distributor Bia Tosha as urgent, as it aims to prevent Diageo from selling its 65% stake in EABL to Asahi for $2.3 billion. The court will provide guidance on whether the deal can continue while the current competition litigation is being resolved.

Tanzania’s CBR

Tanzania’s central bank has kept its policy rate unchanged at 5.75% for Q1 2026, citing expectations that inflation will remain within the 3%–5% target range.