WEEKLY MARKET ANALYSIS, FRIDAY NOVEMBER 28, 2025

A week of contrasting fortunes defined the market, as the Equities segment faced a 3.65% pullback while the Bond market saw turnover surge by 113%. Demand for government securities remains robust with T-Bills recording 186.7% oversubscription. Corporate Highlights: Safaricom launches its KES 15B Green Bond, Uchumi rallies +45%, and Kenya Airways issues a profit warning.

Executive Summary

During the week ended 28th November 2025, showed a profound performance in the bond market, equities, derivatives, Eurobonds and the international market.

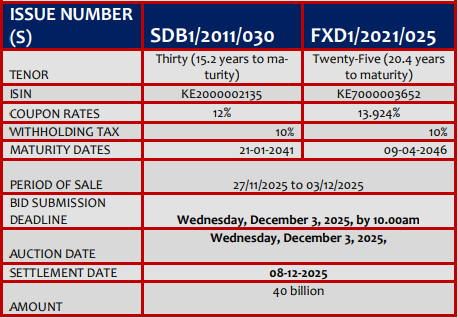

In the domestic fixed– income market, demand remained robust. During the week CBK reopened two Treasury bonds— FXD1/2021/025 and SDB1/2011/030 offering to raise KES 40 Billion. The submission deadline and auction date was placed on Wednesday December 3.

On equities side, the local stock market NSE had a weak week by quite a measure. The broad Nairobi All Share Index decreased by 4.19% compared to the other week ending 21st November. Similarly NSE 20 and NSE 25 experienced a dip down of 4.51% and 4.78% respectively.

Market capitalization decreased also with 4.19% while equities and shares traded increased by 3.7% and 0.5% respectively.

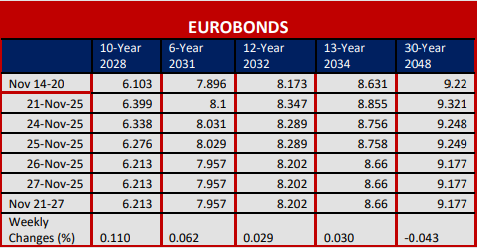

Yields on Kenya’s Eurobond increased by 3.8 basis point on average compared to the previous week, Which suggested a slight shift upward in yields. However it indicates modestly increased risk perception or demand for higher returns by investors for the period.

The Kenya Shilling remained stable against major international and regional currencies during the week ending November 27, 2025. It exchanged at Kes 129.86 per U.S. dollar on November 27 and 150.4128 against Euro on the November 27, 2025.

International oil prices edged downwards slightly as rising supply outpaced weak global demand. The Murban oil price declined to USD 64.46 per barrel on November 27, from USD 65.25 per barrel on November 20

The inflation stood at 4.5%as of 31st October.

International Market

U.S. Treasuries significantly influenced the global bond market last week, with the 10-year Treasury yield dropping to approximately 4.018% due to soft economic indicators and heightened expectations for a Fed rate cut exceeding 80%.

German Bonds also declined, with the 10-year yield hitting around 2.67%, largely following U.S. trends despite a stable ECB outlook. Japanese Government Bonds (JGBs) experienced a slight easing to about 1.801%, supported by dovish commentary from the Bank of Japan and demand for long-dated bonds.

UK Gilts saw a similar yield reduction to around 4.447%, reflecting global easing trends and mixed domestic data impacting future Bank of England

See Table 1

Source: CBK statistics

Bond Market

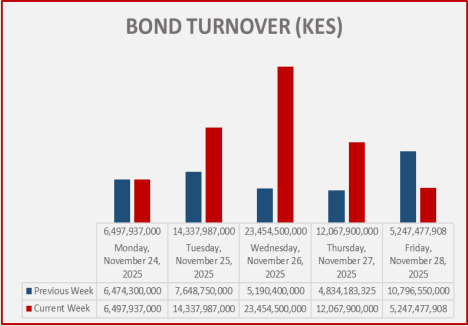

Bond turnover in the domestic secondary market increased by 113% during the week ended November 28, 2025 . In the international market, yields on Kenya’s Eurobonds increased by 3.75basis points on average.

Below is the performance of the bond turnover for the week ended 28th November in graphical and statistical way.

Also see the performance of the Treasury Bills— 91 days and 182 days, in attachment

Treasury Bills

This week marked the eighth consecutive week of oversubscription for T-bills, with an overall subscription rate of 186.7%, up from 180.9% the previous week.

The 91-day paper saw heightened interest, achieving a subscription rate of 448.6% with bids of KES 17.9 Bn against KES 4.0 Bn offered. Conversely, the 182-day paper's subscription rate fell to 5.2% from 42.3%, while the 364-day paper's rate rose to 263.5% from 257.3%. The government accepted KES 44.80 Bn of bids, translating to a 99.98% acceptance rate.

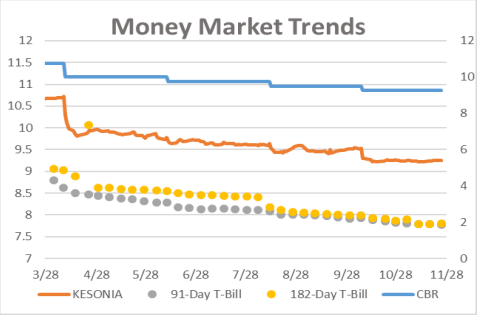

Yields showed a mixed performance; the 364-day paper yield declined by 0.3 bps to 9.376%, the 91-day paper yield fell by 0.1 bps to 7.78%, and the 182-day paper yield remained unchanged at 7.8%. This is described by table 3

Treasury Bonds

The government is seeking KES 40 billion in budgetary support via re-opened 30-year SDB1/2011/030 (12% coupon, maturing 21 January 2041) and 25-year FXD1/2021/025 (13.924%, maturing 9 April 2046) T-bonds.

The last SDB1 reopening on 8 September 2025 mobilised just KES 8.07 billion out of KES 20 billion on offer (40.35% performance, KES 2.40B accepted at a 13.96% weighted average rate), after a June 2025 reopening that drew KES 101.36B in bids vs KES 50B on offer (KES 71.64B accepted).

This offer runs from 27 November 2025–3 December 2025, auction date on 3 December 2025, settlement date on 8 December 2025.

See table 4;

International Bond Market

U.S.A treasuries significantly influenced the global bond market last week, with the 10-year Treasury yield dropping to approximately 4.02% due to soft economic indicators and heightened expectations for a Federal rate cut exceeding 80%.

German bonds also declined, with the 10-year yield hitting around 2.67%, largely following U.S. trends despite a stable European Central Bank.

Japanese government bonds experienced a slight easing to about 1.80%, supported by dovish commentary from the Bank of Japan and demand for long-dated bonds.

United Kingdom gilts saw a similar yield reduction to around 4.447% , reflecting global easing trends and mixed domestic data impacting future Bank of England rate assessments.

Equities

The market capitalization this week lowered in performance compared to the last week.

The market cap this week closed at KES 2,857.36 Billion reflecting a 3.65% decrease compared to KES 2965.5 Billion of the previous week.

Market cap shows a vigorous performance of rises and falls as from January 2025.

See table 5

Table 5

Money Market

The Kenya Shilling remained stable against major international and regional currencies during the week ending November 28, 2025. It exchanged at KES 129.46 per U.S. dollar on November 24, compared to KES 129.86 per US dollar on November 27. On average the Kenyan Currency against the USD exchanged at KES 129.73.

It also performed well against the Euro, Chinese Yuan, pound and many more.

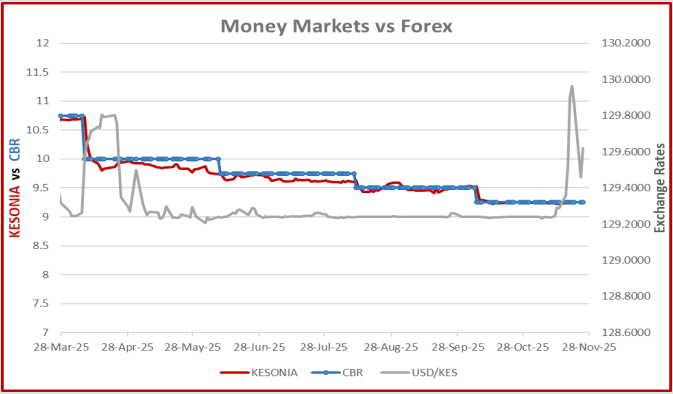

Below is the performance of US dollar against Kenya Shilling showing stability of KES against the dollar.

Central Bank Rate (CBR) remained constant showing a uniform trend of 0.25 basis point average reduction.

KESONIA showed a vigor performance over the week.. See table 6

table 6

Inflation

The overall inflation in the month for the month of November stood at 4.5% being a decrease of 0.1% compared to October’s rate.

The core inflation stood at 2.3% with maize flour being the most significant driver

Non– core inflation rate stood at 10.1% with increase in vegetable prices being the primary reason that the non-core inflation rate is more than four times that of the core rate.

General Market Overview

Top Gainer: Uchumi Supermarket +45.9% to KES 1.08

Top Loser: Carbacid –10.8% to KES 27.55

NASI: ▼3.65% to 181.1

Market Cap: KES 2.86T (–3.65%)

Bond Turnover: KES 61.6B (+76.3%)

Equity Turnover: KES 3.17B (–17.3%)

Net Outflow: KES 619.9M

Weekly Trends

Safaricom has opened Tranche 1 of its Green Notes offer under the newly approved KES 40B Medium Term Note programme: This tranche will have a size of up to KES 15B with a KES 5B green shoe option. The 5-year notes are priced at 10.40% per annum (EABL notes were The notes are senior and unsecured and will be listed on the NSE minimum subscription is KES 50k with KES 10k increments. All proceeds will finance eligible green projects under Safaricom’s Sustainable Finance Framework. The offer runs from 25 November to 5 December 2025 with allotment 8 December and listing on 16 December.

The Nairobi Securities Exchange announced that trading in East African Portland Cement PLC shares has been reinstated after a review resolved the issues that led to the temporary trading halt. Normal trading has now resumed.

British American Tobacco Kenya announced the resignation of Ms. Waeni Ngea as Company Secretary effective 31 December 2025. The Board has appointed FCS Kathryne Maundu as the new outsourced Company Secretary effective 1 January 2026.

Kenya Airways warns that its 2025 earnings will fall by at least 25% compared to 2024. The decline is linked to global engine and spare-parts shortages that have grounded three Boeing 787-8 aircraft about a third of its wide-body fleet reducing capacity and passenger numbers despite ongoing industry recovery