WEEKLY MARKET ANALYSIS, FRIDAY DECEMBER 19, 2025

Lower interest rates, active Treasury bond reopening, falling Eurobond yields, and major corporate developments; including the landmark EABL stake sale and Safaricom’s oversubscribed bond; shaped market activity. Here’s a breakdown of how markets performed in Week 51 and the signals investors are watching going into 2026.

Executive Summary

During the week ended 19th December 2025, the market showed a robust performance in the bond market, equities, derivatives, Eurobonds and the international market.

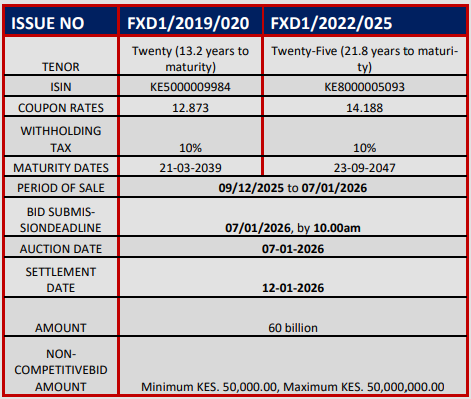

During the week CBK continued to air the prospectus for the reopened –20 and –25 years treasury bonds— FXD1/2019/020 and FXD1/2022/025 with the auction and settlement date being 7th January 2025. Similarly , they continued to air prospectus for the switch from FXD1/2016/010 which is maturing next year, to reopened FXD1/2022/015.

On equities’ market the NSE 20 increased by 3.9% to 3070.2 points from 2954.14 of the previous week. NSE 25 increased by 5.2% to 5023.0 from 4776.8 of the previous week. NASI also increased by 3.5% to 183.8 compared to 177.7 of the previous week.

Market capitalization increased by 4.0% to 2901.2 compared to 2789.7 of the previous week while equities trades decreased by 33.4% to KES 2.9 Bn

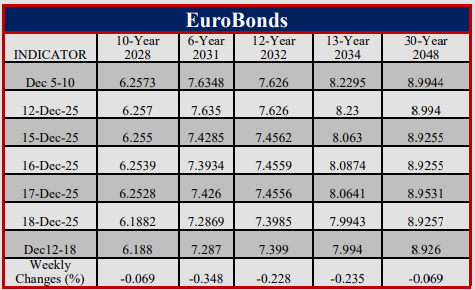

Yields on Kenya’s Eurobond decreased by 18.97 basis point on average compared to the previous week. However it indicates modestly increased dependency in external borrowing.

The Kenya Shilling remained stable against major international and regional currencies during the week ending December 19, 2025. however it gained strength against the US Dollar over the week. It exchanged at KES 128.94 per U.S. dollar on average for the week.

International oil prices declined on account of oil inventory buildup basically due to the ongoing Ukraine-Russia wars, with Murban oil trading at USD 62.71 per barrel on December 19.

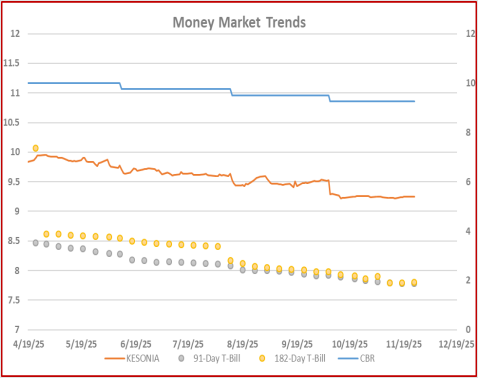

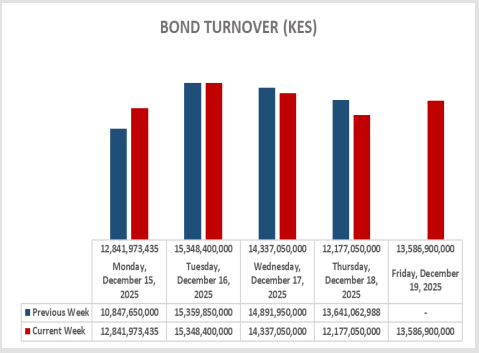

Bond turnover in the domestic secondary market increased by 24.8% during the week ended 19th Dec 2025The Monetary Policy Committee lowered the Central Bank Rate (CBR) to 9.0% at its December 9, 2025 meeting. This affects all related factors including the KESONIA ands lending rates expected to lower.

International Bond Markets

US Treasury yields saw fluctuations influenced by macroeconomic data, with lower yields supporting bond prices and expectations of rate cuts in 2026.

The Bank of Japan's policy shift raised rates, impacting global bond markets and enhancing foreign investment in Asian bonds.

In Germany, Bund yields were mildly affected by EU fiscal events, stabilizing near year-end.

UK gilt yields remained high but are expected to decline gradually due to easing inflation and anticipated monetary policy shifts by the Bank of England.

Money Markets

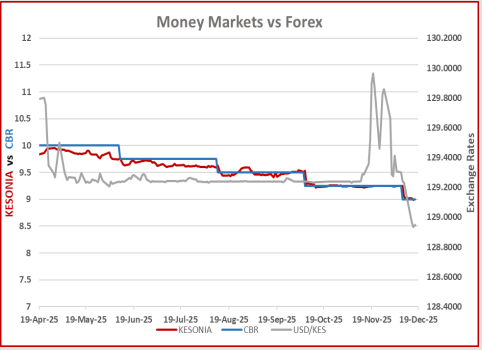

The Kenya Shilling remained stable against major international and regional currencies during the week ending December 19, 2025.

It gained strength against the US Dollar. it exchanged at KES 128.94 per U.S. dollar on December 19, compared to KES 129.16 per US dollar on December 11. On average the Kenyan Currency against the USD exchanged at KES 128.95. see graph 3.

It also performed well against the Euro, Chinese Yuan, pound and the African currencies.

Central Bank Rate (CBR) dropped to 9.00% from 9.25% following the Monetary Policy Committee (MPC) meeting held on 9th December 2025. This sows a trend of 25 basis points cut– rate for the past preview. It will however influence KESONIA and lending rate to lower.

KESONIA showed a vigor performance over the week. See graph 4.

Kenya Primary Bond Market

Treasury Bond

CBK is offering investors a voluntary switch from Treasury bond FXD1/2016/010 (10Year, 15.039% coupon, maturing August 2026, yield 8.0277% ) to the re-opened FXD1/2022/015 (15Year, 13.942% coupon, maturing April 2037).

The KES 20 billion auction runs 9 December 2025 – 19 January 2026, with settlement on 21 January 2026.

The Central Bank of Kenya also reopened its 20 year (FXD1/2019/020) and 25-year (FXD1/2022/25) fixed-coupon Treasury bonds, targeting KES 60 billion.

Sale runs 9 December 2025 – 7 January 2026, with settlement on 12 January 2026. Their coupons are : 12.873% (20Year) & 14.188% (25Year). See table 1.

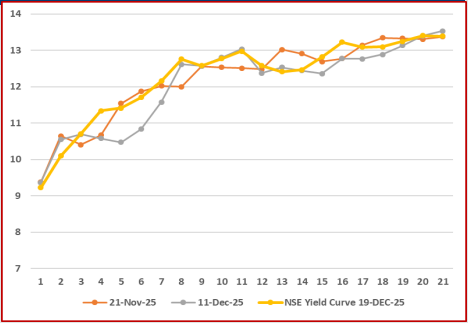

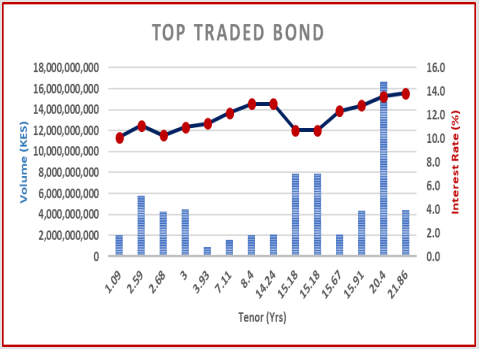

Kenya Secondary Bond Market

The bond market ended December 19, 2025 showed a marginal RISE in performance closing at KES 68.29 billion from KES 54.74 Billion in the Week ended 11th Dec 2025.

In the international market, yields on Kenya’s Eurobonds decreased by 18.97 basis points on average. See table 2.

In attachment, is the performance of the Daily bond turnover for the week ended 19th December in graphical and statistical way.

The long term bonds performed best for the week ended 11th December. See table 5

Weekly Snapshot

EABL Sale

British multinational company Diageo has agreed to sell its entire 65% stake of ownership in East Africa Breweries Limited (EABL) to Japanese Beverage firm, ASAHI Group holdings.

The deal is worth KES 296.6 net of tax and transaction costs. This comes months since Nik Jhangiani, Diageo’s interim chief executive, said the company was planning significantly divestments to help reduce its debt burden.

However, from the statements issued, the Japanese Group stated that it expected EABL to remain listed on the Kenya Uganda and Tanzania stock exchanges once the deal is complete.

EABL bought the firm for 22 Billion in 2023 and is selling at 69 Billion making a 47 Billion profit in 2025

Safaricom Tranche 1 Bond

SAFARICOM accepted KES 20 Billion from the offers by exercising a KES 5 billion green shoe option.

The Green bond was oversubscribed, with 2,453 individuals offered the telecom KES 39.9 Billion. The Telco raked in Sh41.8 Billion against initial Sh15 Billion.

Statistically, each individual raised an average Sh16.2 millions in a span of 11 days, reflecting the millions in the hands of retail investors amid a recovering Kenyan economy.

Capital Market Authority (CMA) questions EABL over Diageo exit bond timing

CMA has raised queries and pushed East Africa Breweries to explain the firms raising KES 16.8 billion through a bond and the announcement of Diageo exit within a span of 39 days, happening concurrently.

The NSE over the week had halted the trading of the EABL shares for most part of the day on Wednesday.

Kenya Airways Change of Power

Allan Kilavuka has exited as the managing director of KQ following his retirement.

Kilavuka has been the KQ boss since 1st April 2020. Previously served as CEO of Jambojet.

Forex

Kenya's forex reserves surged by $68M this week to USD 12.133B equivalent to 5.3 months of import cover.

National Infrastructure Bond

The Kenyan Cabinet approved the National Infrastructure Fund and Sovereign Wealth Fund to anchor a KES 5 trillion long term economic transformation roadmap.

The National Infrastructure Fund, structured as an LLC, will mobilize domestic savings, monetize public assets and crowd in private capital while reducing reliance on debt and taxation.

Equities

The market capitalization this week marginally increased in performance compared to the previous week.

The market cap this week closed at KES 2,901.18 Billion reflecting a 4.0% increase compared to KES 2789.65 Billion of the previous week.

Market cap shows a vigorous performance of rises and falls as from January 2025 previously clocking KES 3 trillion. See graph 7.

The NASI all shares ROSE by 3.5% to 183.8 compared to 177.6 of the previous week.

NSE 25 increased by 5.2% to 5,023.0 from 4,776.8 of the previous week.

NSE 20 share price indices increased by 3.9% closing at 3,070.2 during the week ending 19th December 2025 compared to 2,954.1 of the previous week.

Weekly Market General Overview

NSE Week 51 ; 15Dec –19 Dec

Bonds Turnover: KES 68.29B (+24.8%)

Equity Turnover: KES 7.7B (+46.7%)

Top Gainer: EA Breweries +24.06% to KES 288.75

Top Loser: Uchumi -39.62% to KES 0.96

NASI: +3.9% to 183.8

Market Cap: KES 2.9T (+4.0%)