WEEKLY BOND MARKET REPORT, FRIDAY JANUARY 16, 2026

Kenya’s markets had a busy week, with heavy bond trading, easing Eurobond yields, and a shilling that refused to budge. Behind the calm surface, shifting interest rates, global oil prices, and international bond moves are quietly reshaping the outlook for investors. This breakdown captures what actually mattered, and why it could affect your next move.

MARKET OVERVIEW

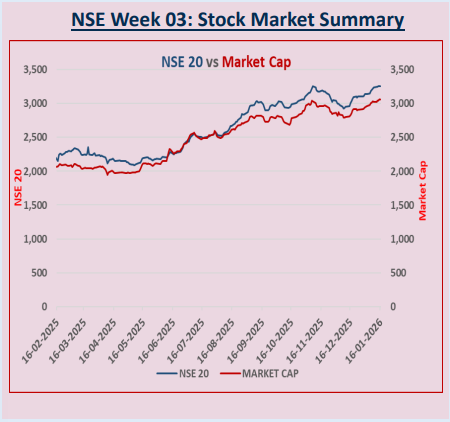

During the week ended 16th January 2026, the market showed a robust performance in the bond market, equities, derivatives, Eurobonds and the international market.

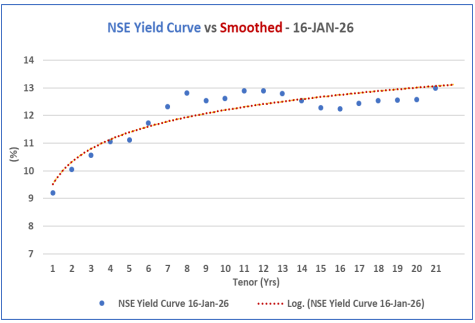

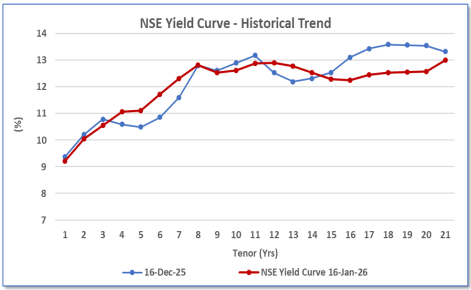

The NSE yield curve has generally edged upwards in the medium-term end 5 to8 year horizon while remaining relatively stable in the short-term and long-term end.

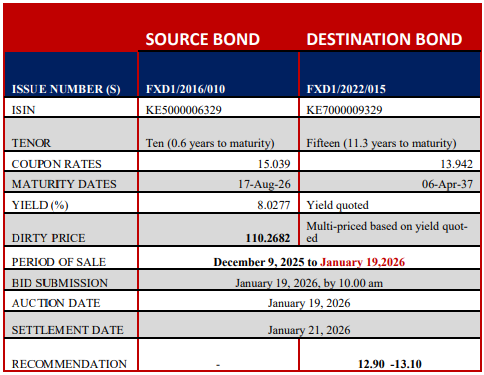

CBK continued to air prospectus for the voluntary switch from FXD1/2016/010 which is maturing in August, to the treasury bond FXD1/2022/015.

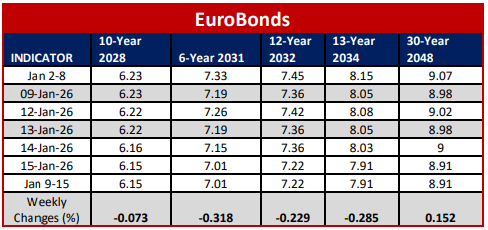

Yields on Kenya’s Eurobond declined for the second consecutive week by an average of 24.13 basis point compared to the previous week. The Eurobonds performed generally low all over the continent.

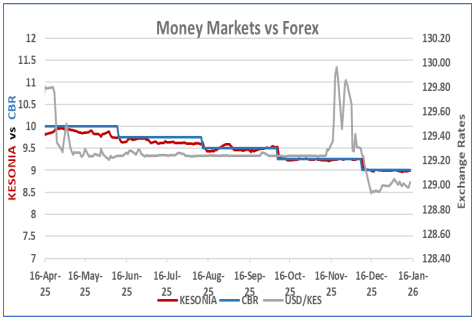

The Kenya Shilling remained stable against major international and regional currencies during the week ending January 16, 2026. It exchanged at KES 129.01 per U.S. dollar on average for the week

The Monetary Policy Committee lowered the Central Bank Rate (CBR) to 9.0% at its December 9, 2025 meeting. This affects all related factors including the KESONIA ands lending rates expected to lower.

International oil prices increased during the week. Murban crude oil traded at USD 64.31 per barrel on January 14, from USD 61.00 per barrel on January 10 due to increased draw-down of US oil inventories, amid elevated oil market concerns arising from heightened geopolitical risks.

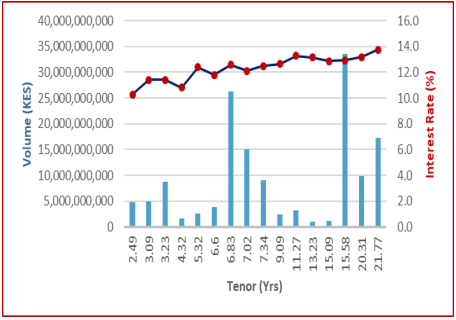

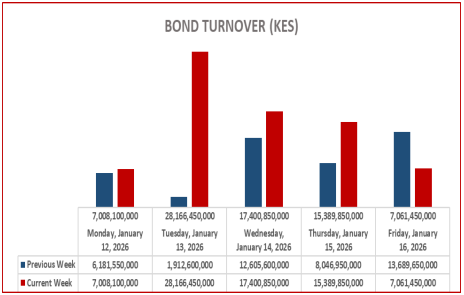

Bond turnover in the domestic secondary market increased by 76.8% during the week ended 16th January 2026.

INTEREST RATE OUTLOOK

Money Market Trends

The Kenya Shilling remained stable against major international and regional currencies during the week ending January 16, 2026.

It exchanged at KES 129.03 per U.S. dollar on January 16th , compared to KES 128.98 per US dollar on January 12th . On average the Kenyan Currency against the USD exchanged at KES 129.01 over the week.

Central Bank Rate (CBR) dropped to 9.00% from 9.25% following the Monetary Policy Committee (MPC) meeting held on 9th December 2025. This shows a trend of 25 basis points cut– rate for the past preview.

KESONIA remained relatively stable at 9.00% on 16th Jan.

Short End of the Yield Curve and Inflation Trends

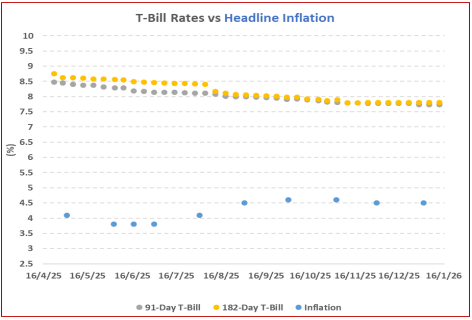

This week, T-bills were oversubscribed for the third consecutive week with a subscription rate of 128.4%, down from 130.3% last week.

The 91-day paper saw reduced demand, attracting KES 1.0 billion in bids against KES 4.0 billion offered (24.0% subscription rate), significantly lower than 108.5% previously.

Subscription for the 182-day paper fell to 5.8% from 96.1%, while the 364-day paper's rate rose to 292.8% from 173.2%.

The government accepted KES 28.5 billion of KES 30.8 billion bids, with an acceptance rate of 92.5%. Yields varied, with the 182-day yield stable at 7.8%, while the 91-day and 364 -day yields decreased slightly to 9.2% and 7.7%, respectively.

KENYA SECONDARY BOND MARKET TRENDS

The NSE yield curve has generally edged upwards in the medium-term end 5 to 8 -year horizon while remaining relatively stable in the short-term and a relative decline in the long-term end.

Week-on-week traded volumes have generally been consistent across the two week period with turnover spiking within the week, the turnover rose with a great margin for the week ended 16th January 2026.

KENYA PRIMARY BOND MARKET

Treasury Bond Auctions

During the week, the Central Bank of Kenya continued to broadcast the prospectus for the voluntary switch from maturing bond FXD1/2016/010 to the reopened FXD1/2022/015.

The period of sale ran from December last year and lapses on January 19th, next week.

Central bank anticipates to collect KES 20 Billion from the sale.

The destination bond was previously reopened in November 2025, experiencing an oversubscription.

FXD1/2016/010 matures in August of this year.

INTERNATIONAL BOND MARKETS

The 10-year U.S. Treasury yield rose modestly to approximately 4.19%, reflecting mixed market sentiment concerning monetary policy and geopolitical risks.

The UK saw a decline in 10-year gilt yields from around 4.37% to 4.34%, attributed to improved investor confidence and expectations of further rate cuts by the Bank of England.

German Bond yields remained largely unchanged, staying around 2.83% to 2.84%, due to a lack of significant macroeconomic triggers.

Japanese JGB yields rose to about 2.1% to 2.2%, driven by tightening monetary conditions and fiscal uncertainties.

China- limited yield data were reported, with onshore markets influenced by credit developments, leading to relatively subdued bond yields compared to developed markets.

KENYA EUROBOND MARKET

Yields on Kenya’s Eurobonds performed relatively lower over the week, indicating borrowing costs or risk perceptions in the international fixed-income market.

On average, yields declined by average of 20.13 basis points across outstanding Eurobond issues. This suggests some downward price movement or rebalancing by investors in response to global market conditions.

In attachment, is the performance of the Daily Eurobond turnover for the week ended 16th January 2026 in graphical and statistical way.

BULLETIN BOARD

INTERNATIONAL MARKET

Kenya has initiated trade negotiations with China, following its exclusion from Beijing's duty- and quota-free access scheme for least-developed countries.

The discussions have led to a preliminary agreement that provides zero-duty access for 98.2% of Kenyan goods.

SUGAR MARKET

In the first 11 months of 2025, Kenya’s sugar production declined by 37.4%to 551.8 Bn Tonnes as local businesses faced fierce competition due to factory outages and the expiration of COMESA safeguards.

BANKING IN ETHIOPIA

Private-sector credit in Ethiopia has experienced a significant increase, reaching 77%, driven by recent reforms in monetary policy, foreign exchange, and the financial sector.

Inflation has decreased from more than 30% in June 2019 to 9.7% by December 2025

SAFARICOM SHARE SALE

The Treasury disclosed that the assessment of Safaricom’s KES 34 price was mainly founded on the 6-month VWAP of KES 27.5, while DCF and DDM offered conservative downside limits.

Peer EV/EBITDA multiples were employed to establish the upper limit, and 12-month analyst target prices acted as forward-looking negotiation references